The Buzz on Paul B Insurance

Wiki Article

Not known Details About Paul B Insurance

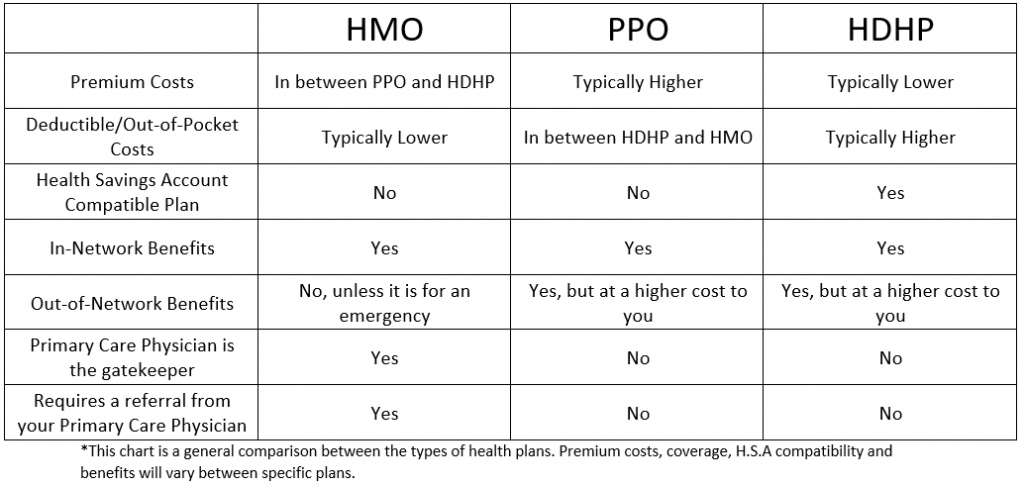

Related Subjects One factor insurance issues can be so confounding is that the health care market is continuously transforming as well as the coverage plans supplied by insurance companies are difficult to categorize. In various other words, the lines in between HMOs, PPOs, POSs and various other sorts of protection are frequently blurred. Still, comprehending the makeup of numerous plan types will be useful in evaluating your alternatives.

PPOs normally provide a wider selection of carriers than HMOs. Premiums might resemble or slightly greater than HMOs, and out-of-pocket prices are typically greater as well as more complicated than those for HMOs. PPOs enable individuals to venture out of the company network at their discernment and do not call for a recommendation from a medical care medical professional.

Once the insurance deductible quantity is reached, extra health and wellness expenses are covered based on the provisions of the health and wellness insurance coverage policy. A staff member might then be liable for 10% of the expenses for treatment obtained from a PPO network service provider. Down payments made to an HSA are tax-free to the company as well as worker, and also money not invested at the end of the year may be rolled over to pay for future clinical expenses.

What Does Paul B Insurance Mean?

(Employer contributions have to be the exact same for all employees.) Employees would certainly be accountable for the initial $5,000 in medical prices, but they would each have $3,000 in their individual HSA to pay for clinical costs (and also would have also a lot more if they, as well, contributed to the HSA). If employees or their families exhaust their $3,000 HSA quantity, they would pay the next $2,000 expense, whereupon the insurance coverage plan would begin to pay.

There is no restriction on the amount of money an employer can contribute to employee accounts, nonetheless, the accounts may not be funded with staff member salary deferrals under a lunchroom plan. In addition, employers are not permitted to reimburse any type of component of the equilibrium to employees.

Do you understand when one of the most wonderful time of the year is? No, it's not Christmas. We're chatting regarding open enrollment season, infant! That's! The wonderful time of year when you get to compare medical insurance plans to see which one is right for you! Okay, you obtained us.

Examine This Report about Paul B Insurance

But when it's time to choose, it is necessary to know what each strategy covers, just how much it costs, as well as where you can use it, right? This stuff can feel complicated, however it's much easier than it seems. We placed together some practical discovering steps to aid you feel certain regarding your alternatives.

(See what we did there?) Emergency situation care is frequently the exemption to the guideline. These strategies are the most preferred for people that get their medical insurance via work, with 47% of protected employees registered in a PPO.2 Pro: Most PPOs have a suitable selection of providers to pick from in your location.

Disadvantage: Greater costs make PPOs more costly than various other kinds of plans like HMOs. A health care company is a wellness insurance coverage strategy that usually just covers care from physicians who help (or agreement with) that particular plan.3 So unless there's an emergency, your strategy will not pay for out-of-network treatment.

Facts About Paul B Insurance Uncovered

More like Michael Phelps. It's great to recognize that plans in every category give some types of cost-free preventative care, and some deal totally free or discounted medical care solutions before you fulfill your deductible.

Bronze plans have the most affordable regular monthly premiums yet the greatest out-of-pocket prices. As you work your way up via the Silver, Gold and Platinum groups, you pay more in premiums, however much less in deductibles and coinsurance. As we stated in the past, the extra costs in the Silver category can be decreased if you qualify for the cost-sharing reductions.

Reductions can lower your out-of-pocket healthcare costs a lot, so obtain with among our Backed Neighborhood Suppliers (ELPs) who can aid you figure out what you may be eligible for. The table below shows the percentage that the insurer paysand what you payfor covered expenditures after you meet your insurance deductible in each strategy classification.

Paul B Insurance Things To Know Before You Buy

Various other prices, typically called "out-of-pocket" expenses, can include up quickly. Points like your insurance deductible, your copay, your coinsurance quantity and also your out-of-pocket optimum can have a large effect on the total cost. Right here are some expenses to hug tabs on: Insurance deductible the amount you pay before your insurance policy firm pays anything (with the exception of free preventative care) Copay a collection amount you pay each time for things like doctor sees or various other solutions Coinsurance - the percent of medical care services you're accountable for paying after you've why not find out more struck your deductible for the year Out-of-pocket maximum the yearly limitation of what you are accountable for paying look at here now on your own One of the very best ways to conserve money on medical insurance is to use a high-deductible health insurance (HDHP), especially if you do not anticipate to on a regular basis utilize clinical services.

When selecting your medical insurance strategy, do not forget concerning medical care click to find out more cost-sharing programs. These job basically like the various other health insurance coverage programs we described currently, yet technically they're not a type of insurance. Permit us to discuss. Health and wellness cost-sharing programs still have monthly premiums you pay and also defined protection terms.

If you're attempting the DIY path as well as have any kind of lingering concerns concerning medical insurance strategies, the specialists are the ones to ask. And also they'll do greater than just answer your questionsthey'll likewise discover you the best cost! Or perhaps you would certainly such as a means to integrate getting wonderful medical care coverage with the possibility to aid others in a time of need.

All About Paul B Insurance

Our relied on companion Christian Medical care Ministries (CHM) can aid you figure out your options. CHM assists family members share health care prices like clinical tests, maternal, hospitalization and surgery. Hundreds of people in all 50 states have utilized CHM to cover their medical care requires. Plus, they're a Ramsey, Trusted partner, so you recognize they'll cover the medical bills they're supposed to as well as honor your insurance coverage.

Secret Concern 2 Among the things healthcare reform has actually carried out in the united state (under the Affordable Treatment Act) is to present even more standardization to insurance strategy advantages. Prior to such standardization, the benefits provided varied dramatically from strategy to strategy. Some plans covered prescriptions, others did not.

Report this wiki page